How to plan Budget, control Expenses, and Increase Savings?

The Personal Budget Planner worksheet is created to improve your savings. You don’t need to know about budgeting or cash flow, because the worksheet does it for you and guides you through the process, making managing finances easy.

The first step is to create a budget that consists of an income target, an expense budget, and projected savings. These are the essentials in the whole process.

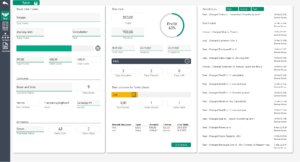

The next step is to record your daily/weekly / monthly expenses and revenue. Then, the data will be visible in dashboards: Cashflow Report, Savings Report, Budget Report, and Asset Report

Personal Budget Planner – 5 years spreadsheet

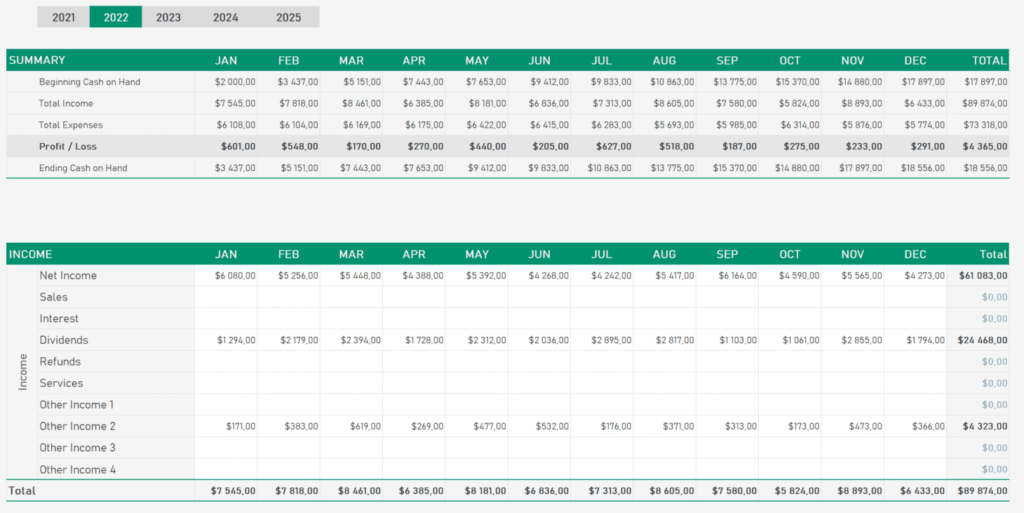

The budget planner is divided into three sections:

Summary, Income, Expenses.

Summary: Check how much money you had at the beginning of the month and how much you will have at the end of each month. The table summarizes the revenues, costs, and savings.

Income: In this table, you assign income by category, which you can modify in the settings tab. Your income budget is your target.

Costs: As in the revenue section, the cost categories can be set in the settings tab. Enter the maximum amount that you should not exceed for a given category

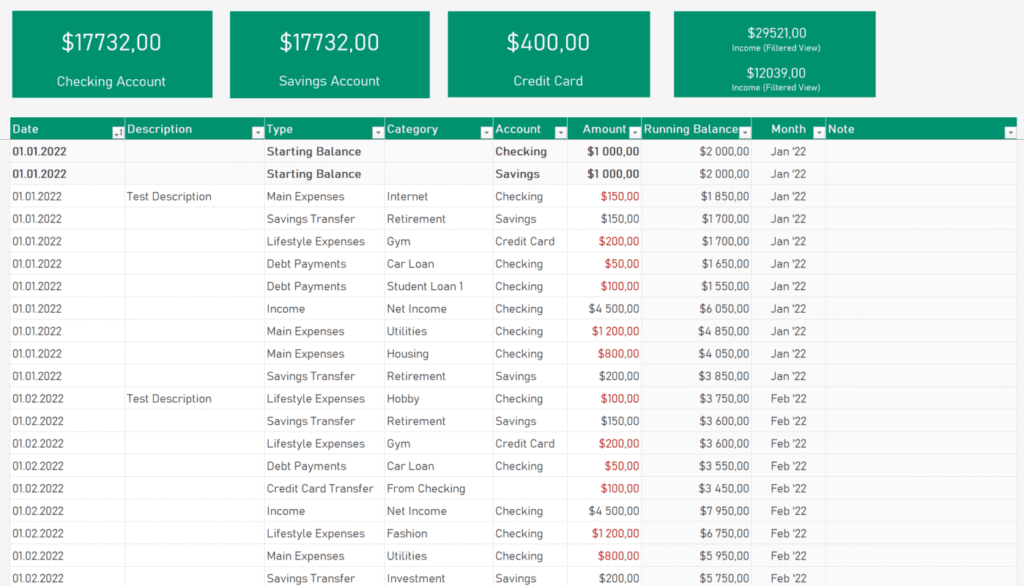

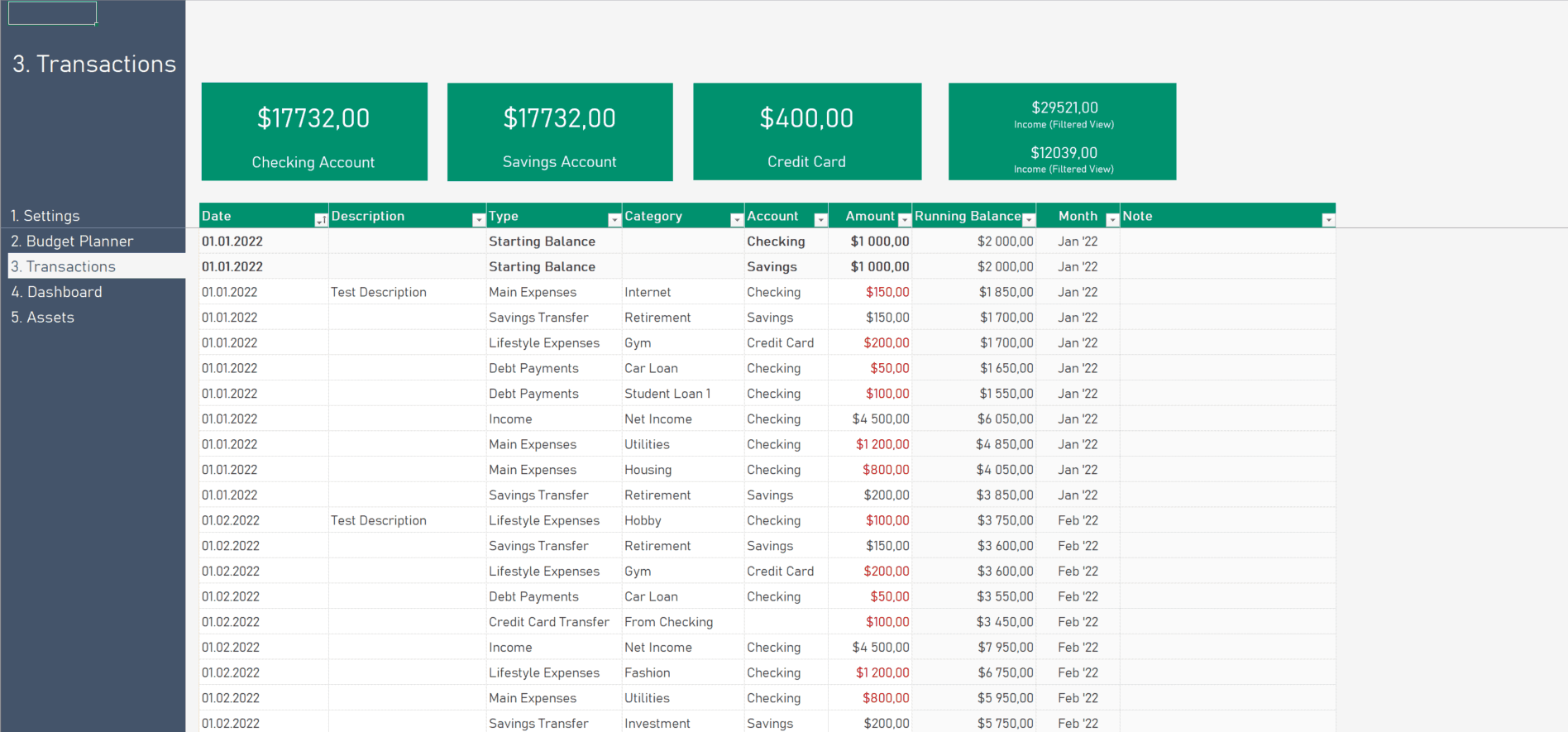

Transactions register to track each expense & income

Have you wondered how you should collect data? It’s easy! We recommend recording expenses and income daily, weekly, or alternatively, in a monthly manner – it’s your choice after all. The table should contain basic information such as amount, income/cost category, and account. The formulas will do the rest.

Multi-dependency makes your work significantly easier.

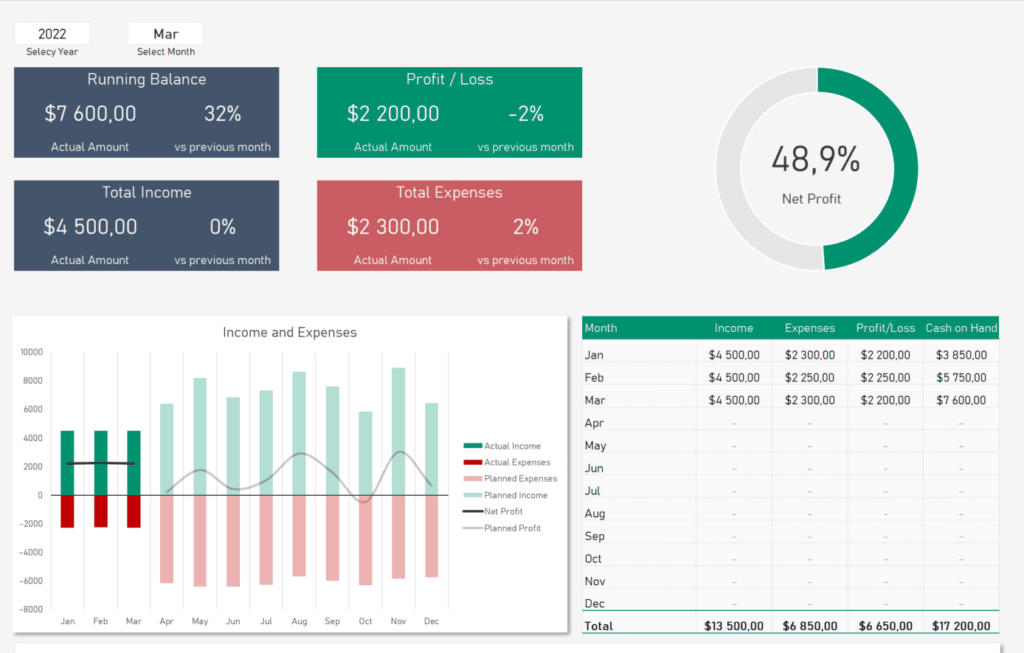

Cashflow Dashboard – Track your Efficiency

Cash flow is one of the most important aspects of controlling your budget.

This is where you can track your current expenses, income and savings.

Tip: Each dashboard can be filtered by year and month.

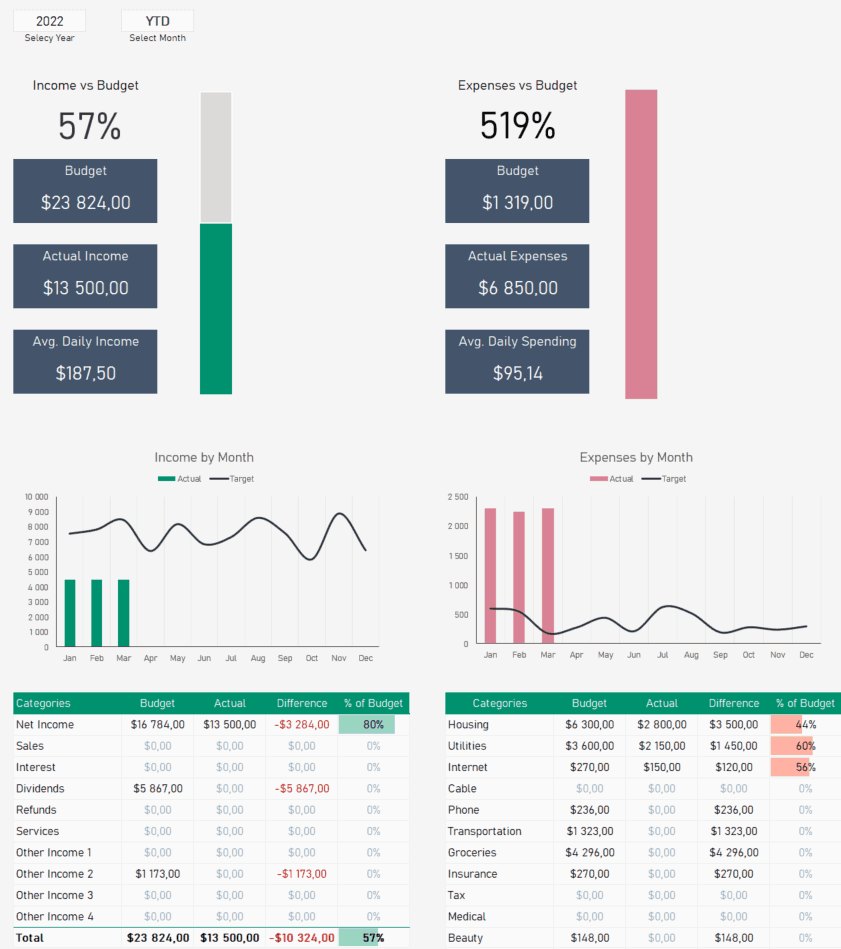

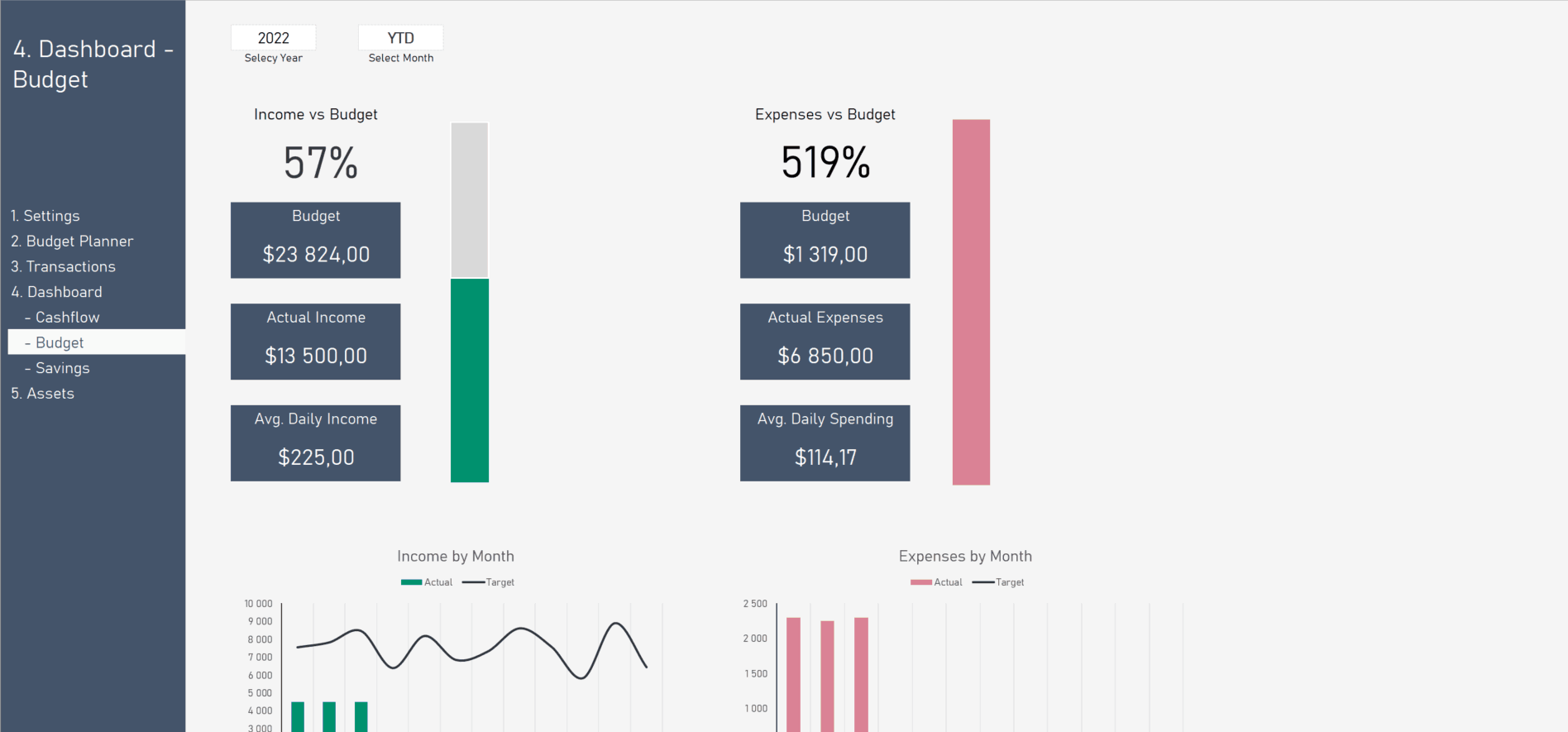

Budget Report – Fast-track to achieve your goals

The budget report is divided into 2 sections, Income, and Expenses. The charts show whether you are going to meet your targets or not. For example, if the income target is $1000 in the given month and you made $ 1100, then the report will show you 110% KPI. The same is for the expense section: let’s say the budget is $1000, and you spent $900, so it’s 90% of the budget and the first sign that you have to cut costs.

Stick to clearly defined budget goals and you will achieve success and save money.

Below the charts, there are detailed tables showing how much % of the budget you have used for selected categories, e.g. Internet, Utilities, Groceries, etc.

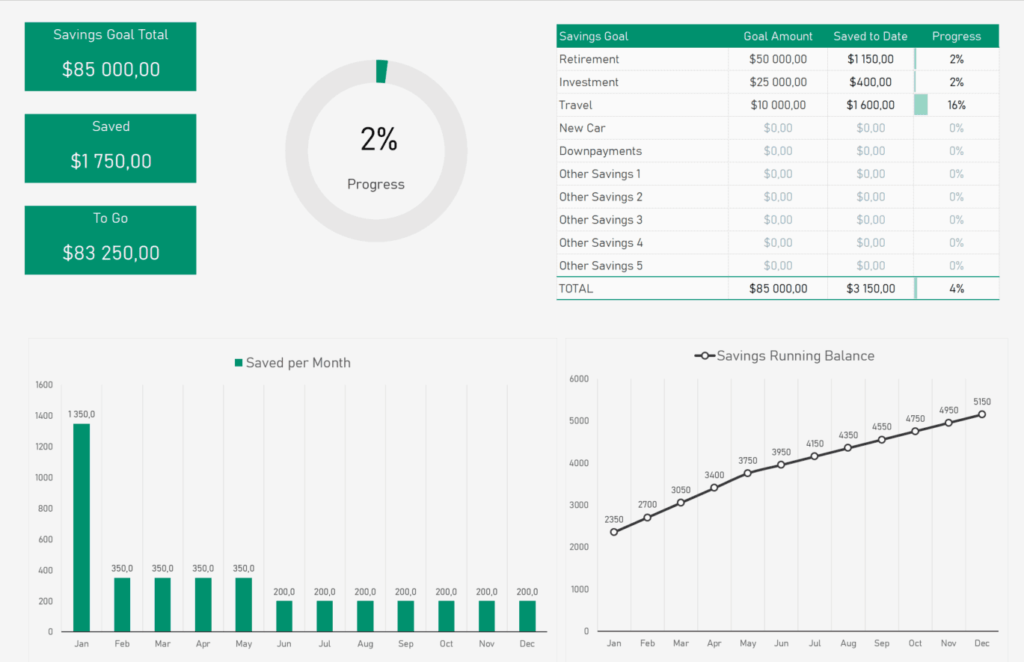

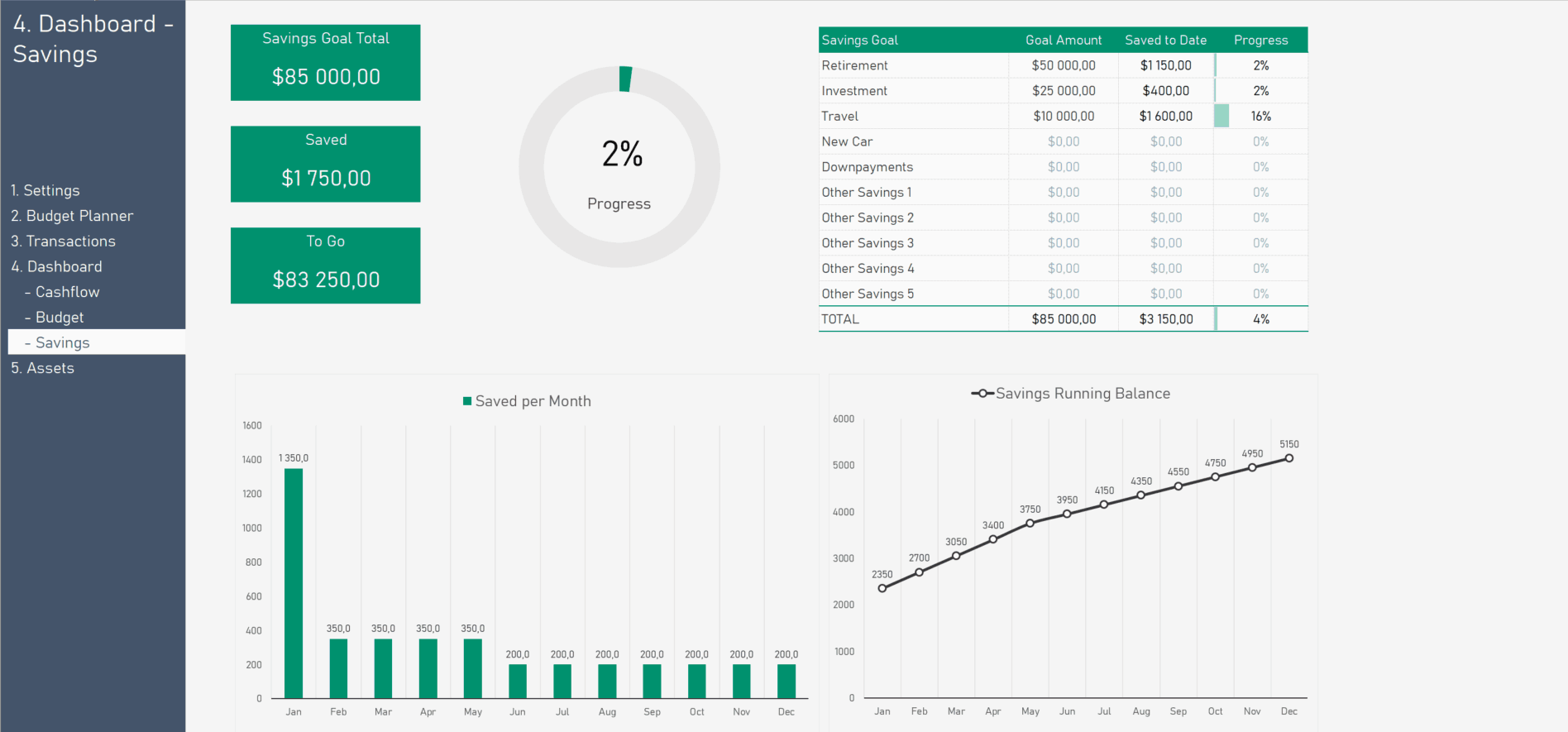

Savings Planner and Dashboard to help you plan your savings efficiently

The savings report is one of the most important dashboard of the spreadsheet. Track how much you have saved during the year and how much you currently have in savings (running balance). There are 3 tiles: the amount of savings, how much you saved, and how much is missing to achieve the goal.

We believe that controlling your savings brings significant results

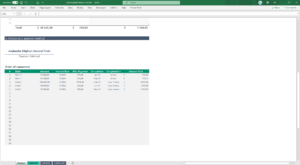

Assets Tracker – Not only business, but also personal

![]()

Last but not least is the Asset Tracker. Its purpose is to visualize the value of your capital. The principle of operation is simple, just enter the values of your assets each month.

Personal assets are things of present or future value owned by an individual or household. It can be cash, property, or any other investment. In personal finances, it’s sometimes called Net Worth. We encourage you to estimate and track this value.

Contents

- Excel Spreadsheet (xlsx file) – ready to use file

- Sample data – to show you how it looks like with some real data

- Compatible with Excel 2013, 2016, 2019, 365

Reviews

There are no reviews yet.