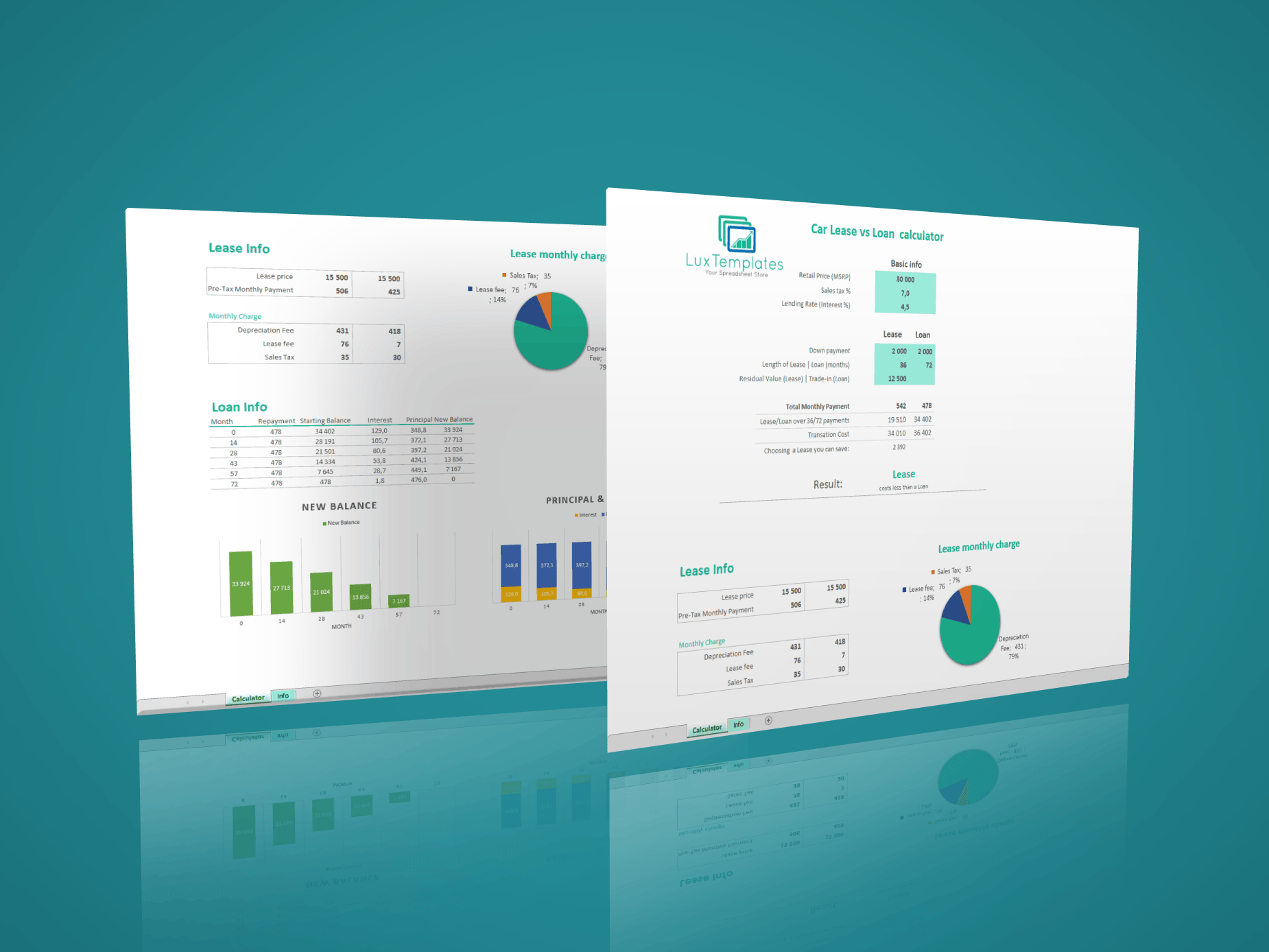

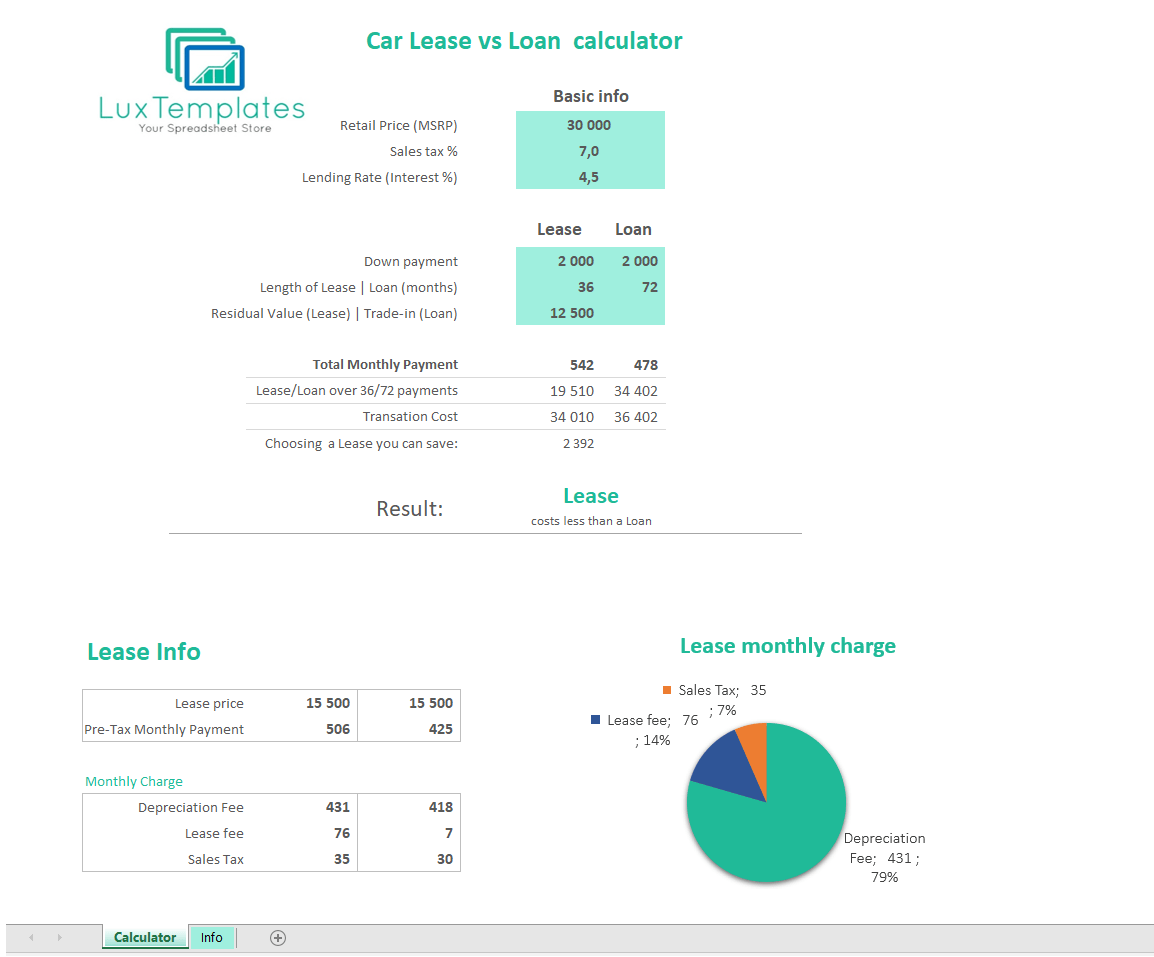

Car lease calculator vs loan calculator

We have prepared a calculator in order to compare the cost of leasing with the cost of a loan for buying a car. Use our Spreadsheet to see what is more profitable for you.

How does the car lease & loan calculator work?

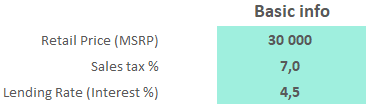

You need to provide several financial figures. As the basic information, provide the retail price of the car, sales tax, and interest.

Then complete the Lease and Loan details. Before entering the data into Excel, check:

- How long do you take out the loan/leasing? (months)

- What value is for a down payment?

- What is the residual value of the car after leasing or for how much you plan to sell the car after paying off the loan?

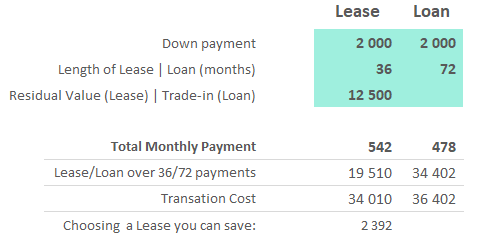

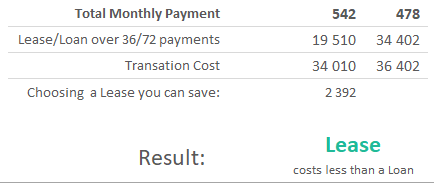

As a result, you get information about what is cheaper, Leasing or Loan, as well as how much you will save by choosing one of the options.

Features:

- Lease vs Loan comparison

- Lease info with trade-in

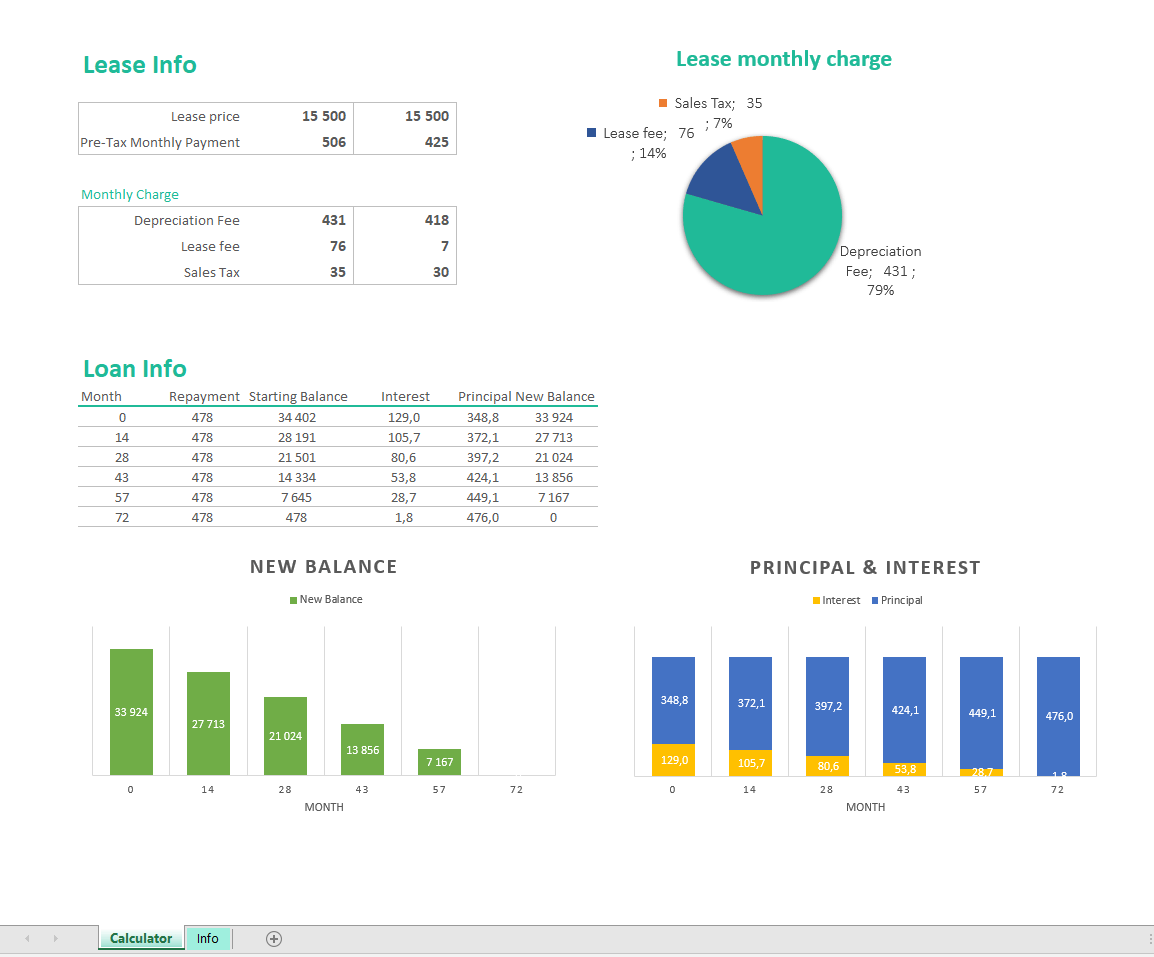

- Pie chart with Lease monthly charge

- Lease taxation

- Lease price and pre-tax monthly payment

- Loan info

- Cost components of the loan: Interest and Principal

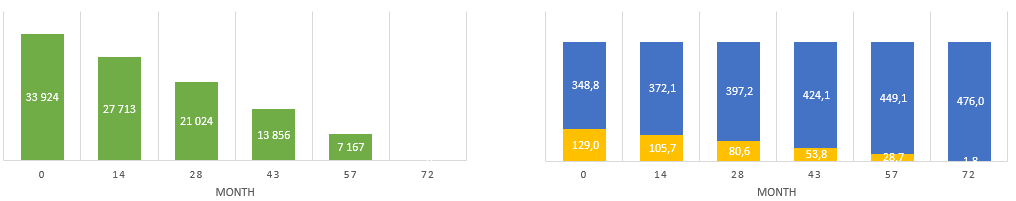

- Bar charts for Loan balance and cost components

Contents:

- Excel 2010 and newer

- Info with 8% Discount coupon (with Modifiable package)

Lease and Loan sum up

Lease

What?

A lease is a use of a car for a fixed period of time at an agreed amount of money for the lease.

At the end of a lease’s term, the lessee must either return the vehicle to or buy it from the owner. The end of lease price is usually agreed upon when the lease is signed.

Why?

- Spread you repayments over X months

- Pay for using the car

- Leased cars can be written off as a business expense

- Don’t worry about the maintenance (most repairs are covered by a manufacturer’s warranty)

- Lease a car for 2-4 years and after that purchase this car or lease a new car

Cost components

- Depreciation – covers the depreciation cost over the lease term

- Sales tax – local sales tax on the down payment and residual value

- Lease fee

Loan

What?

A loan is a common method of buying a car. You’re borrowing the money and then paying it off in installments.

Technically, the dealer sells a car to a bank and you as a borrower, pay off the bank.

To determine what you can afford, check your credit score.

Why?

- Spread you repayments over X months

- The car is yours all the time

- Low-interest rates

- You owe just as much a car is worth (+interest), without fees

- You can take additional GAP insurance (for repairs)

Cost components

- Interest Rate

- Loan Cost– the amount of money you’re borrowing

Try more of our calculators! Goodwill Impairment Calculator or full Financial Statement Analysis – general business model

Reviews

There are no reviews yet.