Efficiently manage your payroll process and generate accurate pay stubs with our user-friendly Payroll Template

Simplify your payroll management and ensure accurate compensation for your employees. This customizable pay slip template is perfect for small businesses, self-employed individuals, and organizations of all sizes. Take control of your payroll operations and optimize efficiency with our user-friendly Excel template!

Payroll Calculator – what’s inside our spreadsheet?

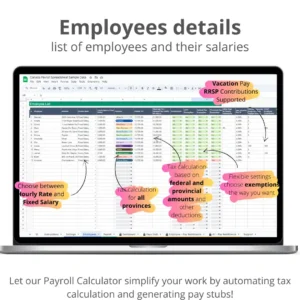

Payroll Calculator to simplify your work.

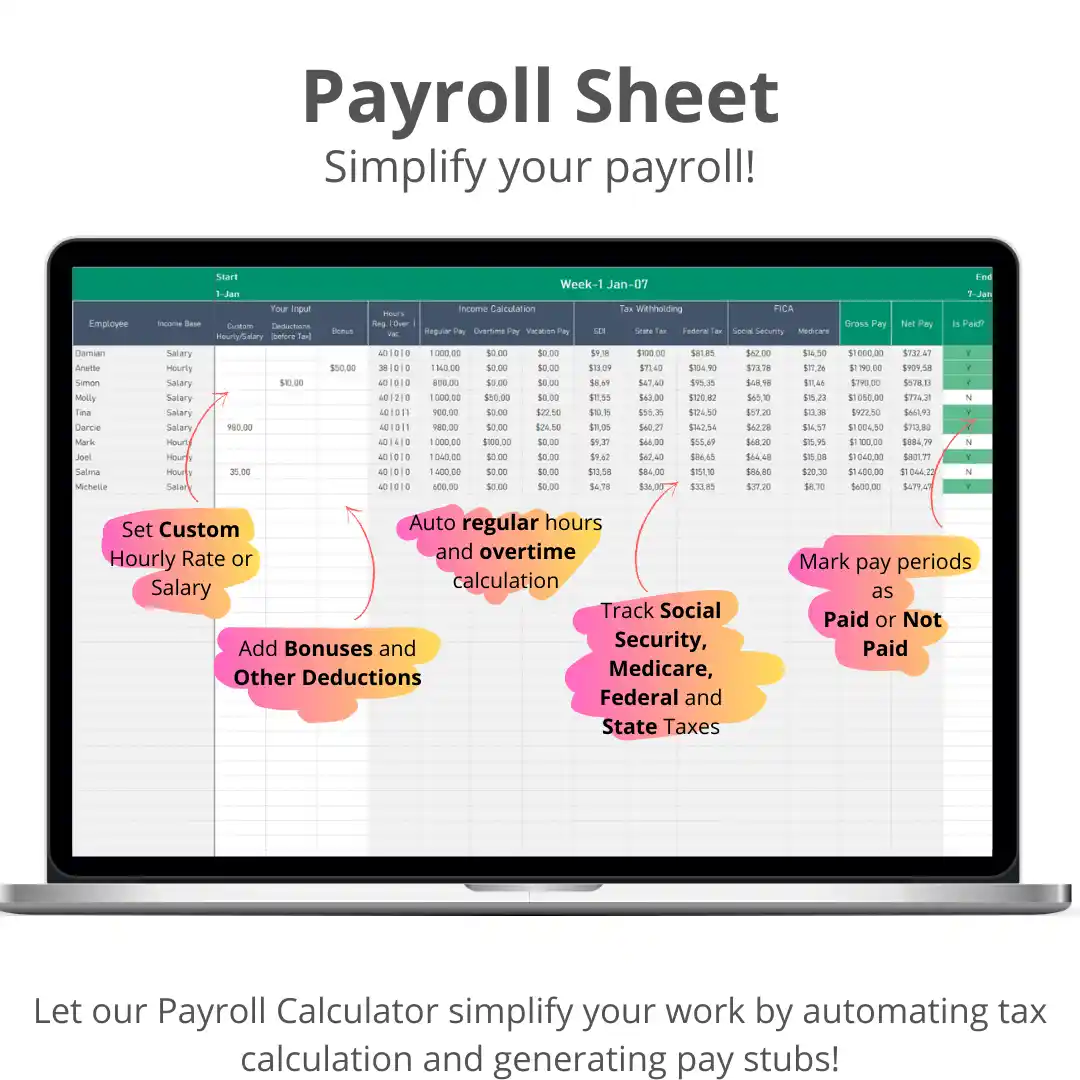

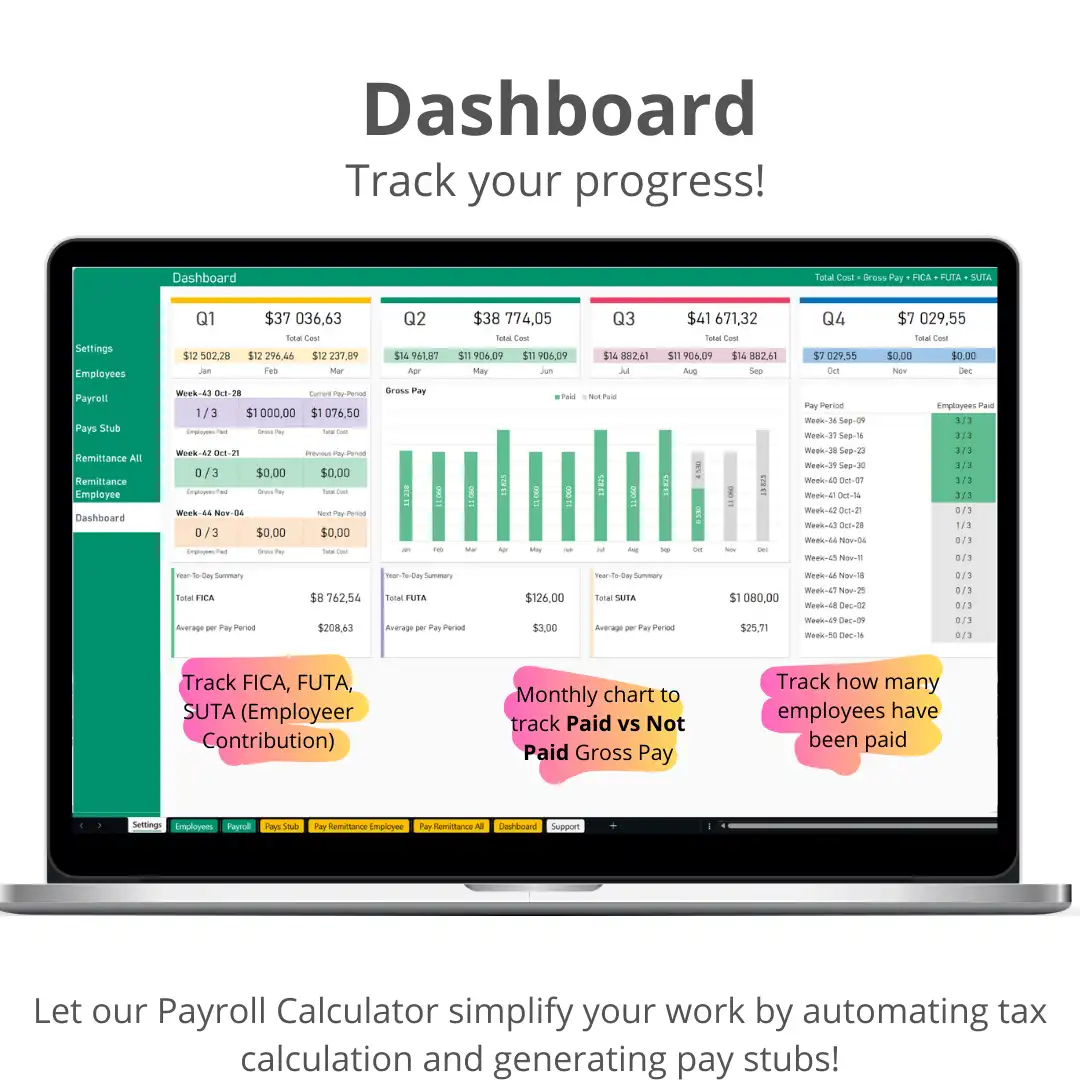

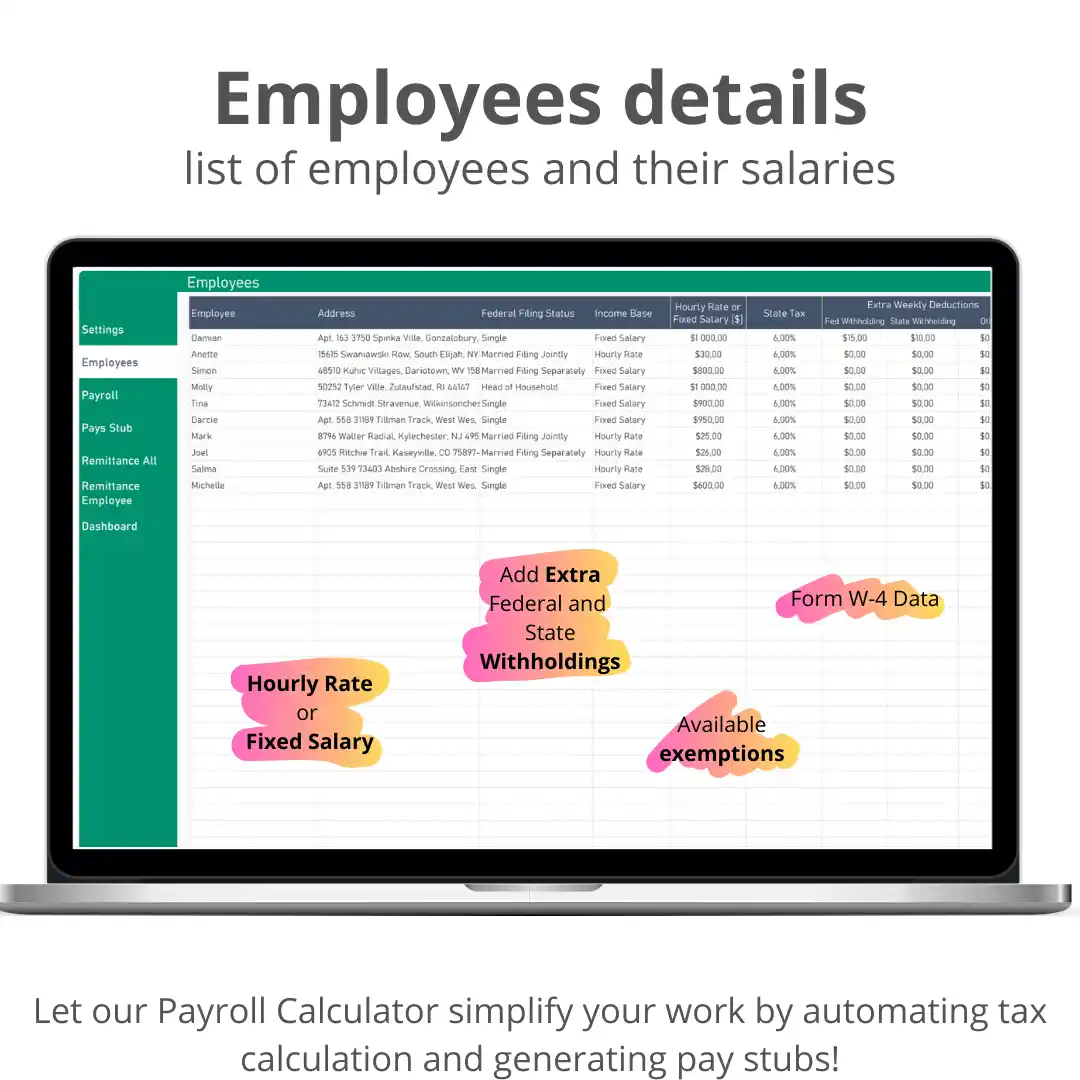

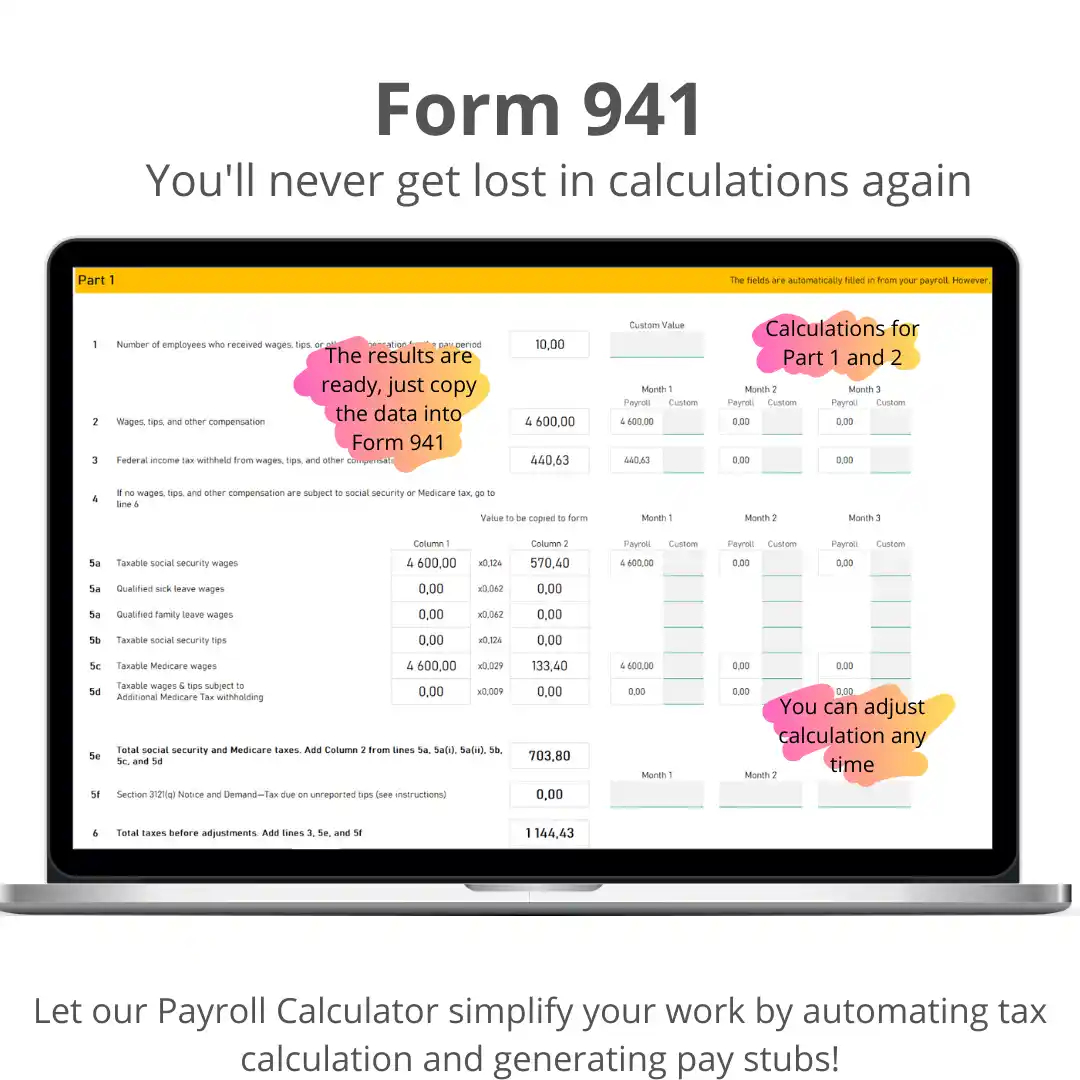

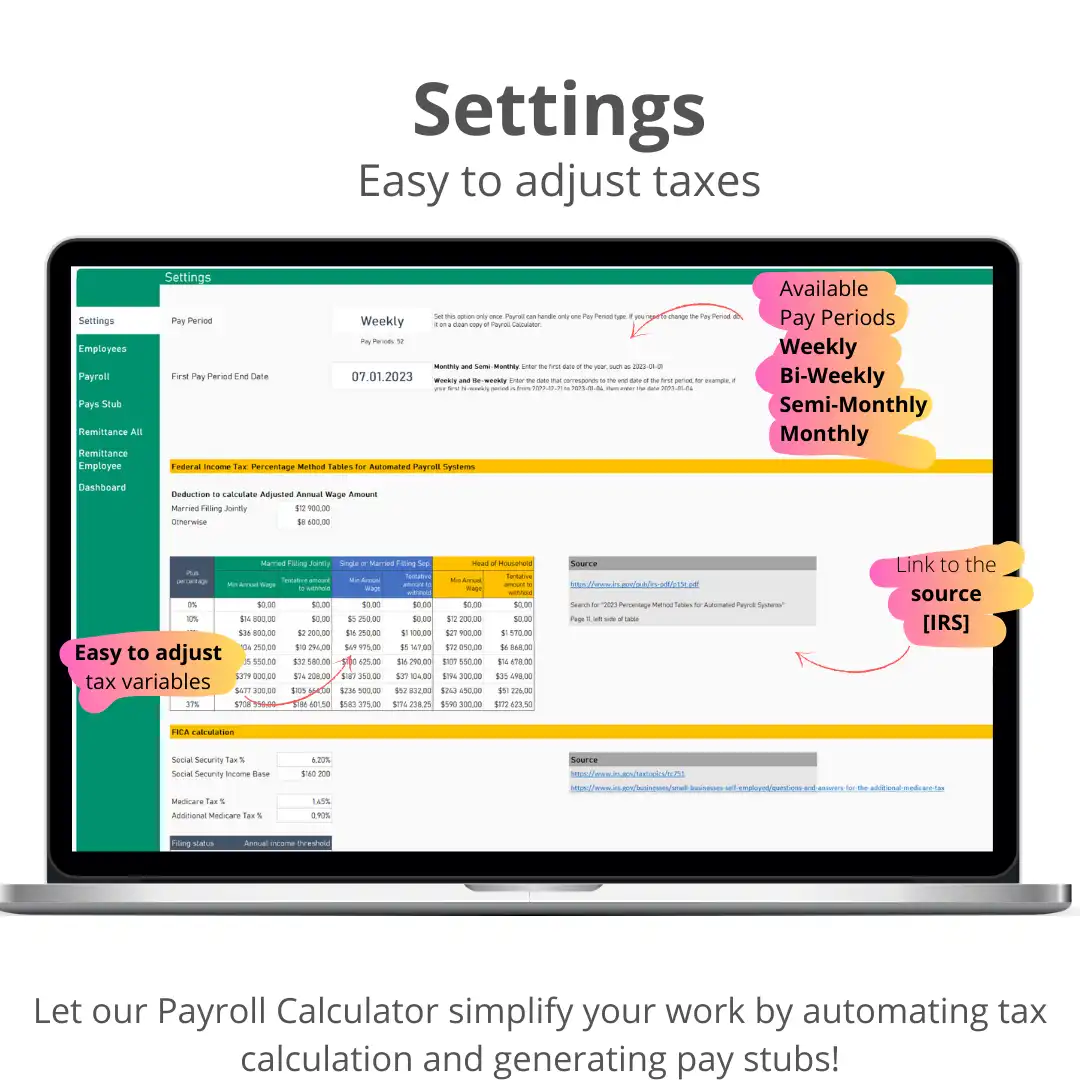

Let our Payroll Calculator simplify your work by automating tax calculation and generating pay stubs!

The Payroll Calculator consists of:

✔ Pay Stubs – ready to be printed or downloaded to pdf

✔ Employee Information sheet

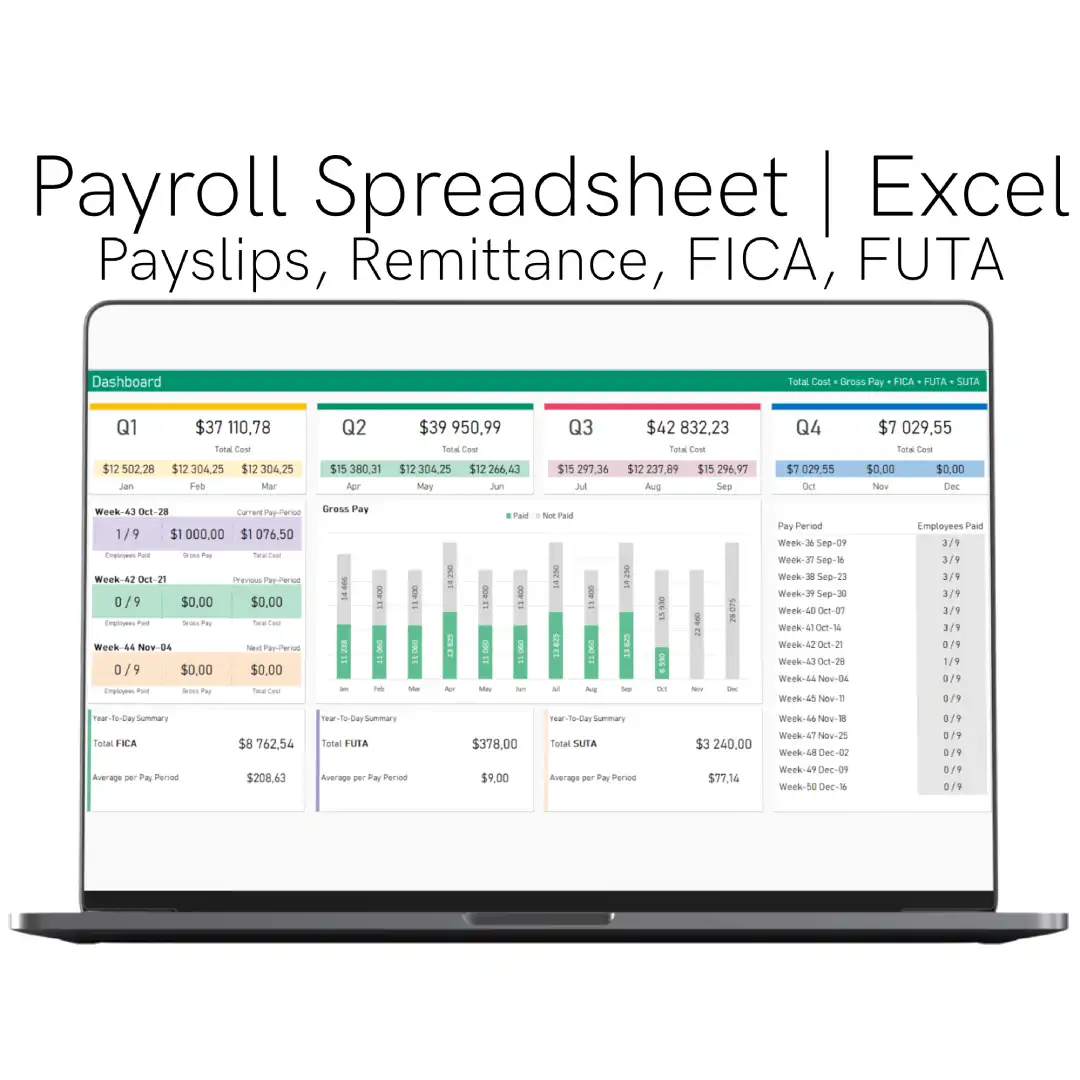

✔ Dashboard

✔ Remittance records (All Employees)

✔ Remittance records (Employee)

✔ Payroll sheet (Weekly, Bi-Weekly, Semi-Monthly, Monthly)

⚑ Payroll was created following IRS guidelines (US)

✨Key Features✨

⚊ Weekly Payroll – US Taxes

⚊ Automated tax calculation for hassle-free payroll management

⚊ Generate professional pay stubs ready for printing or download

⚊ Employee timesheet for easy record-keeping

⚊ Convenient pay remittance summary, both total and by employee

⚊ Register regular work hours, overtime, and sick/vacation hours

⚊ Set overtime rates and deductions for each employee

⚊ Tax planner to handle various tax components such as state tax, federal income, social security, and Medicare

⚊ Payment remittance summary for tax return & Federal 941 reporting purposes

⚊ Deduction tracking to subtract relevant amounts from employees’ total wages

⚊ Compatible with Google Sheets for seamless accessibility and collaboration

⚊ Experience the convenience and accuracy of our Payroll Template. With automated tax calculation, professional paystub generation, and comprehensive tracking features, managing your payroll has never been easier. Save time, reduce errors, and ensure compliance with tax regulations.

✨ Why Choose Our Payroll Template? ✨

Effortlessly manage your self-employed taxes, streamline your payroll process, and stay on top of your financial obligations with our comprehensive Payroll Template. Experience the convenience and accuracy of automated tax calculation, professional paystub generation, and comprehensive tracking features. Save time, reduce errors, and ensure compliance with tax regulations. Take the hassle out of payroll management and provide your employees with accurate and detailed pay stubs. Our Payroll Template is designed to simplify your payroll tasks and transform your payroll management experience.

✨Best for✨

✅Self-employed individuals looking for an efficient way to manage their payroll

✅Small businesses seeking to streamline their payroll process

✅Managers of large companies who need a comprehensive payroll solution

✨Requirements✨

✅ Excel 2013, 2016, 2019, 365

The file extension is .xlsx

⚊⚊⚊ Employee Information ⚊⚊⚊

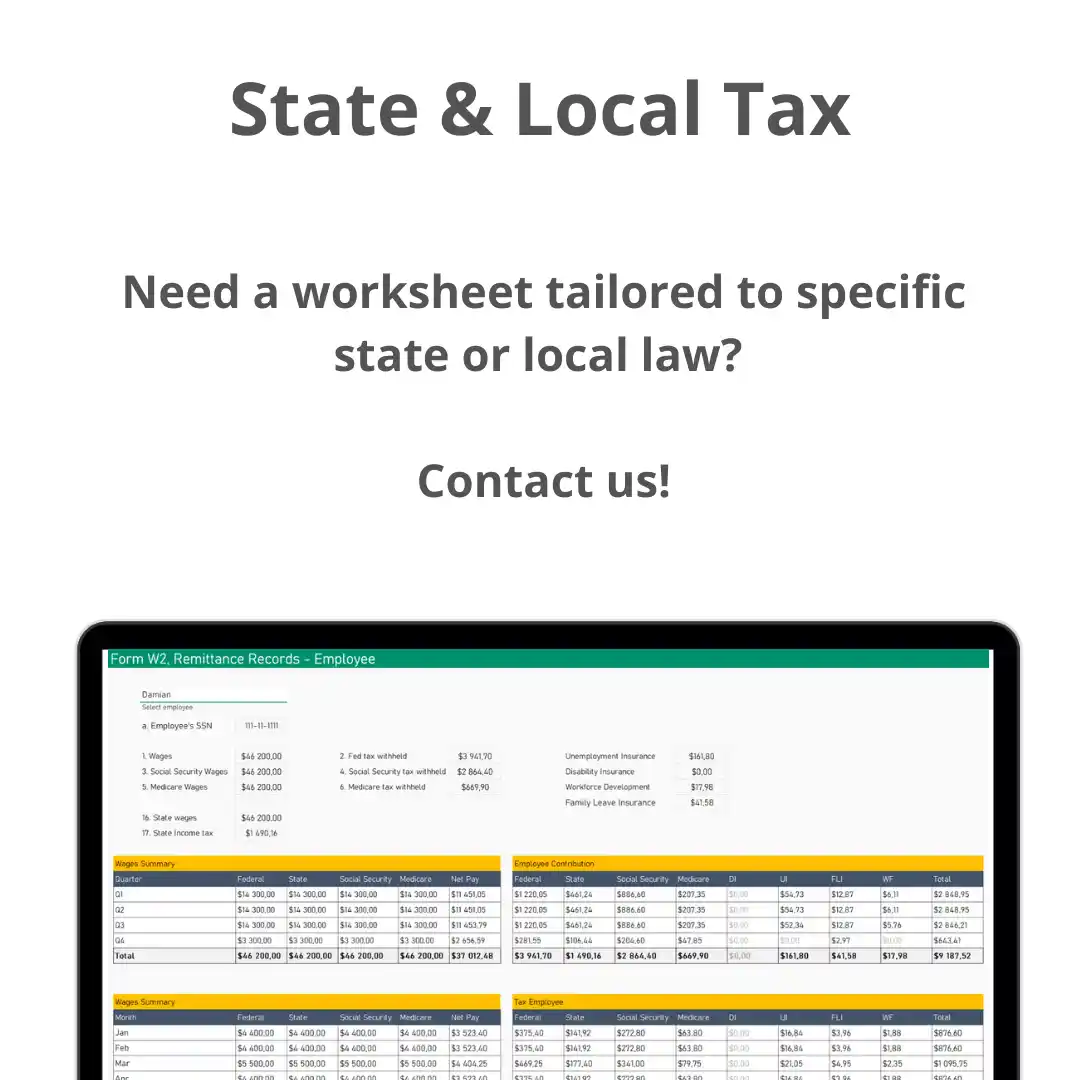

The first task is to collect information from your employees. You can do this using Form W-4. Next, provide information such as hourly wage (or fixed salary), taxes: state tax, federal income tax, Social Security, Medicare, other deductions, and additional withholdings (federal, state). It would be best to have all of this information to run and distribute payroll properly.

There are 3 types of spreadsheets: weekly, bi-weekly, and monthly.

All sheets contain tables where you can record regular working hours, overtime, and sick/vacation hours. You can also set an overtime rate and deductions for each employee. As a result, the spreadsheet calculates gross pay, net pay, and taxes for you.

⚊⚊⚊ Weekly – Bi-Weekly – Sem-Monthly – Monthly ⚊⚊⚊

The sheet supports 4 types of pay periods: Weekly, Bi-Weekly, Sem-Monthly, Monthly

⚊⚊⚊ Payroll and Taxes ⚊⚊⚊

The main area of work is the Payroll sheet in which you can enter:

⚊ Hour Worked (if income base is hourly rate)

⚊ Custom Hourly Rate or Custom Salary

⚊ Overtime

⚊ Vacation

⚊ Bonus

⚊ Other Deductions

The payroll calculates these for you:

⚊ State Tax

⚊ Federal Tax

⚊ Social Security Tax

⚊ Medicare Tax

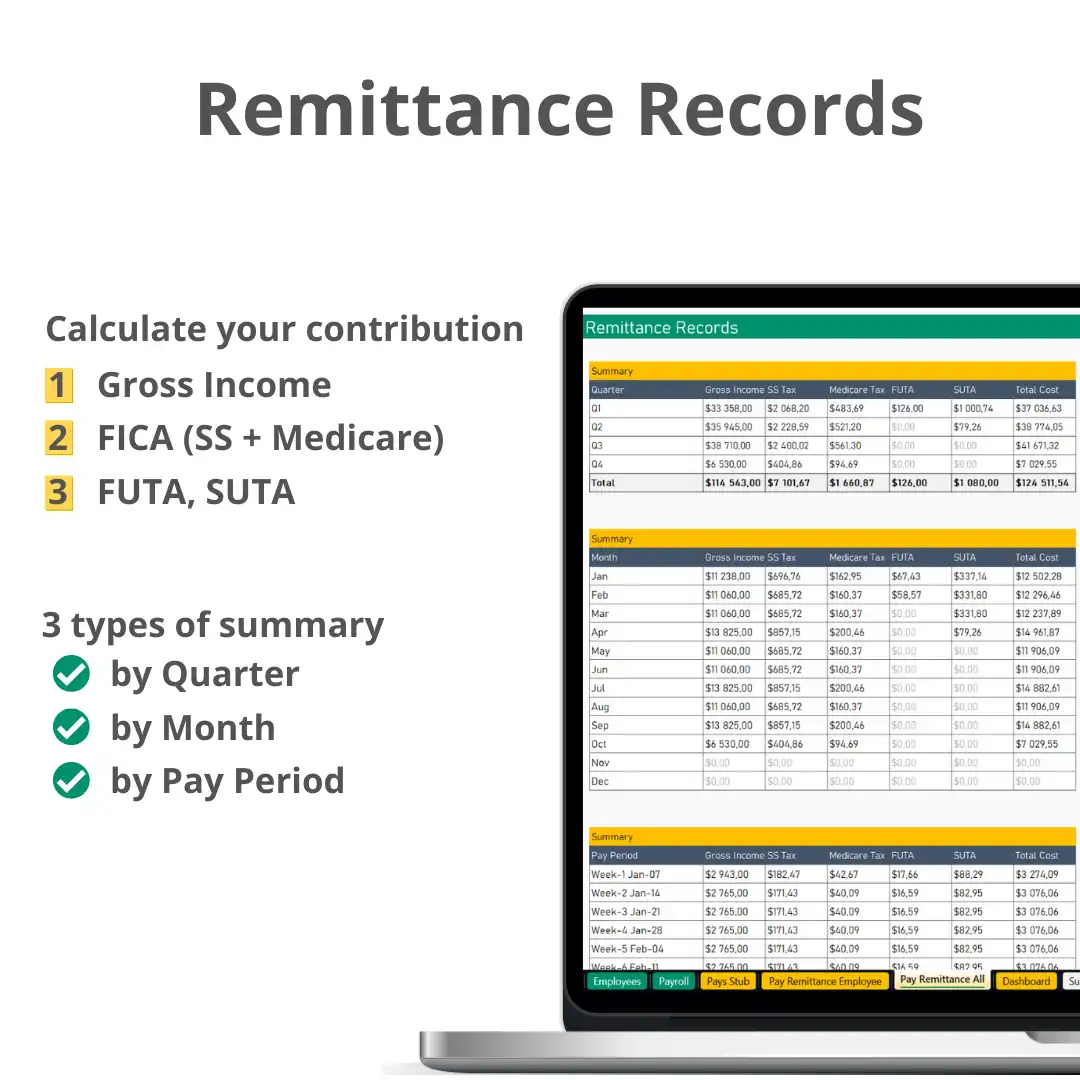

⚊⚊⚊ Payment Remittance Summary ⚊⚊⚊

⚊ Great for Federal 941 reporting purposes

⚊ Calculate Federal Unemployment Tax Act (FUTA) amount

⚊ Calculate the State Unemployment Tax Act (SUTA) amount

⚊ Quarterly & Weekly Summary

⚊ Total Summary

⚊ Summary by Employee

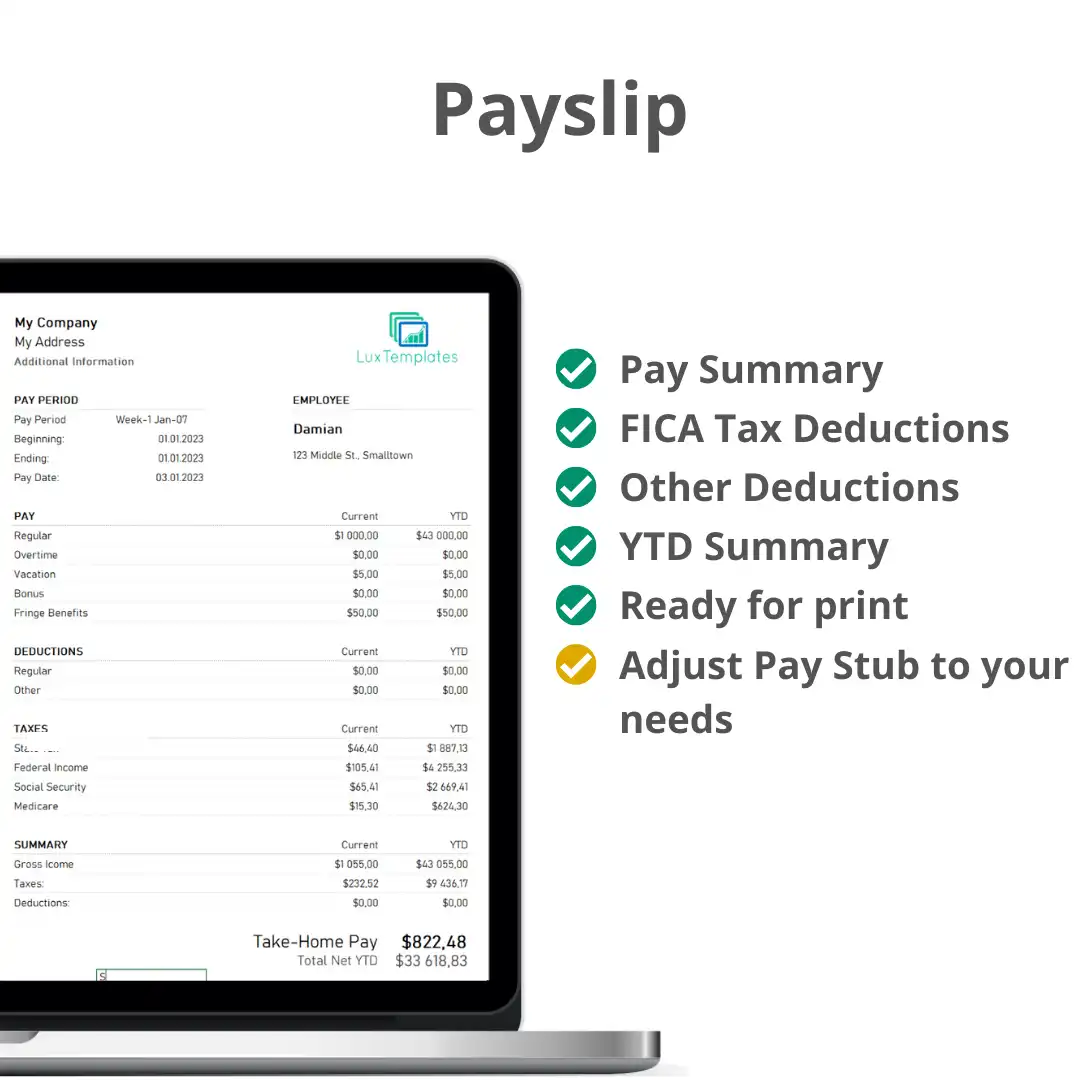

⚊⚊⚊ Pay Stubs – Payroll Calculator ⚊⚊⚊

To make it easier, we have prepared a Pay Stubs sheet – ready to print or generate PDF. It contains all the information about hours worked, earnings, deductions, and taxes.

All you have to do is select Month / Week and then Employee. The formulas will do the rest.

Also, would you like to manage projects or track your sales? Check our Sales CRM

evilTwinMe –

Works great on my excel 365

Mary.H –

Had a lot of issues that were mostly me not understanding the program. I contacted the seller and he was great! He was very kind and understanding and had all of my issues and then some were promptly fixed and the spreadsheet was explained to me so I was able to understand how to use it without anymore problems. This is exactly what I need to do my job at a small business and well worth the money as all of the other programs I looked at were very expensive and had more features that were useless to my business. Thanks again for making my job so much easier!!!

— Review imported from Etsy —

Matt –

Easy template to work with and has been very helpful

— Review imported from Etsy —

Bre.C –

Very easy to use and works great for our business

— Review imported from Etsy —

JEP Construction –

Customer service is A+. The seller responds quickly and is very helpful. Love the template and how easy it is to use. 10/10 would abosolutly recommend.

— Review imported from Etsy —

Angelic –

This is super useful for my brands, great purchase

— Review imported from Etsy —

Andrew.N –

The template was very professionally made. Damian was open to tweaking parts of the template to meet my exact needs. Everything you need to know is explained in detail on the item listing. My purchase exceeded my expectations. Highly recommended.

— Review imported from Etsy —

Avy.L –

A+++!!Best customer service I ever experienced in my life, thank you Damian help my life more easy, he will be there and help u as quick response he can. If I can have more then 5 High recommend

— Review imported from Etsy —

StramaMama –

Needed quarterly summaries for 941 reporting and Damian made a change to make it possible. Thank you.

— Review imported from Etsy —

Josh.F –

Met description and my expectations

— Review imported from Etsy —

Nancy.C –

The quality of the template is amazing. It is exactly what our small business needed. It fully met my expectations, especially after Damian made the slight change to fit my needs. Most of all his customer service was awesome! Look forward to purchasing more of his templates. Thank you!

— Review imported from Etsy —

Jennifer –

This product and customer service exceeded my expectations! When I first purchased the Payroll Calculator, I did not realize that it was for United States businesses, I contacted support/services at Lux Templates to see if I could get assistance in editing the formatting to suit Canadian businesses. Damian replied to me with HOURS, and within a DAY, he provided me with the exact template I was looking for. I very highly recommend this company and its products. The customer service is outstanding. Jennifer (payroll dept at law firm in Canada)

— Review imported from Etsy —

Debbie.M –

A great product for my small business needs. Would definitely recommend this spreadsheet and Pay Stubs. It simplifies everything. Damien was very helpful and responded immediately when I requested an extra line item be added to the Pay Stub tab. Thank you Damien!

— Review imported from Etsy —

Dennis –

Enjoy the spreadsheet. Damian was very helpful in answering questions and providing assistance in customizing my needs. Thank you.

— Review imported from Etsy —

Numaira.S –

I cannot say enough about Damians customer service skills. Not only is he smart but he is helpful, respectful and a genuine person. After numerous back and forth communication i finally purchased a bundle that looked right for me. And i kept on running into problems, not b/c of Damian’s bundle but b/c i couldn’t access information needed to work with the formulas. And he kept on helping me. He personalized it for me so i can use it. I am forever grateful and he is such a gracious person. Very happy i went with him on etsy. Will recommend him to anyone with template needs in a heartbeat.

— Review imported from Etsy —

kohner27 –

Item is great, no question what I wanted!

— Review imported from Etsy —

Deboah.W –

This spreadsheet is amazing. It has exceeded my expectations. I had one adjustment to be made due to the pay schedule and I reached out to Damian and the response and correction was done in less than 8 hours. I will definitely purchase other products when needed, worth every penny. Thanks again for creating such a great tool.

— Review imported from Etsy —

Blootini –

This payroll calculator is amazing. It was scary for me to break my 25yr old QB payroll habit but thanks to Damian I did it! My state calculates swh a little differently, and I have deductions for different items so I mentioned it to Damian and he customized my version to accommodate my specific needs. I wholeheartedly recommend Damian and Lux Templates! Thank you!! 🙂

— Review imported from Etsy —

Cambridge –

Best payroll template for New Jersey companies. I own a small company in New Jersey. Damian has been so patient and really helpful to make a customized payroll template for New Jersey state despites of how complicated and tedious they are. He’s been kindly responding to every feedback I sent and keep sending me the updated spreadsheet until we got a perfect template. For those who needs payroll template in New Jersey, I highly recommend buying templates from Lux Templates. This product is a money and time safer, especially for a small company owner like me who can’t really afford to pay payroll company every month. All of the state deductions are broken down in the template. A++++ seller!!!

— Review imported from Etsy —

Christina –

Very good and easy to use

— Review imported from Etsy —

Inactive user –

Great excel template very concise, I hope I can get the updated tax codes each year.

— Review imported from Etsy —

Teresa.T –

This is exactly what I needed and Damian has went above and beyond to help me with my needs

— Review imported from Etsy —

Lisa.V –

BUY THIS RIGHT NOW. If I could give it 100 stars I would! I cannot say enough good things about this product. From the smooth transaction, easy download to Damian going above and beyond to customize the template to my exact needs, this is BY FAR the best Payroll spreadsheet I’ve worked with and the only one I’ll need going forward.

— Review imported from Etsy —